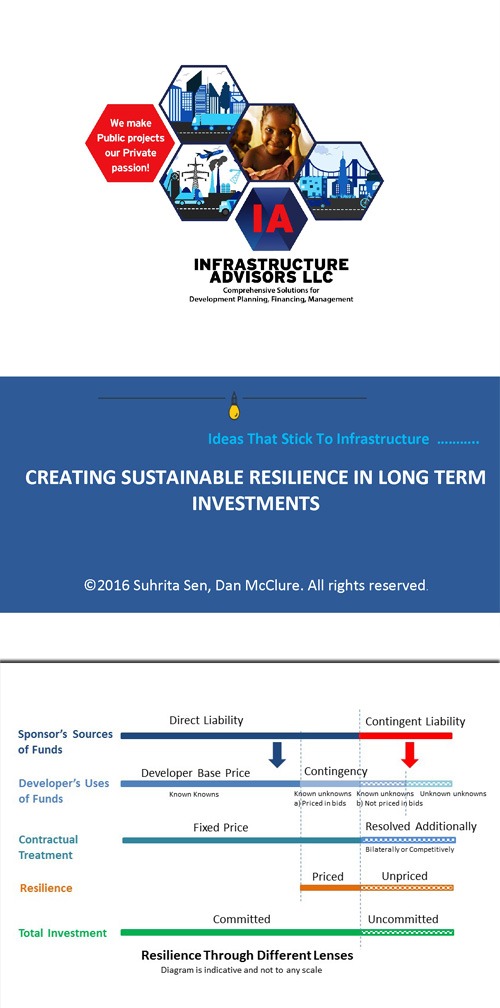

ABOUT US

An overview of our core capabilities and vision.

OUR SERVICES

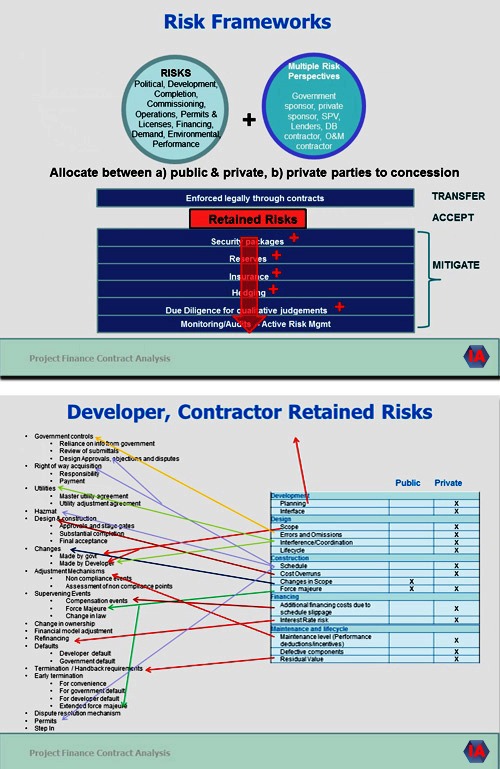

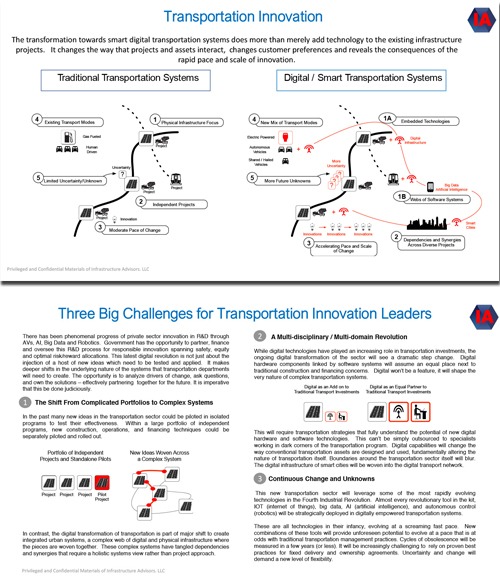

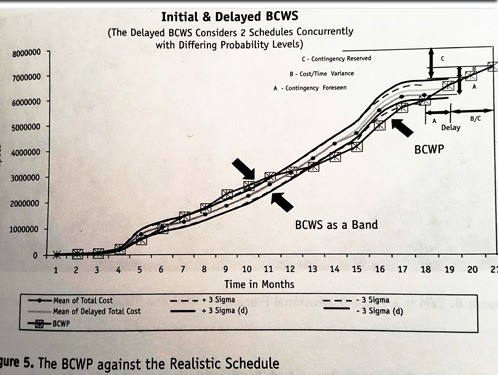

We construct multidisciplinary solutions for advanced infrastructure initiatives that deal with the most pressing issues across planning and development. Like most real world conundrums, infrastructure is not a financial or engineering solution. It requires an ecosystem of interactive and supportive parts. Hence, our strategic advice on the intersection of financial, technical and commercial matters is a proven success factor and a cornerstone of innovation. We advise owners, developers, lenders and investors on the full cycle of assets.

OUR EXPERIENCE

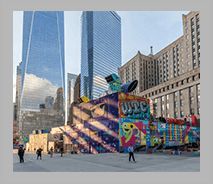

Our contracts span Strategic, Financial, and Technical Advisory services – disrupting the knowledge-based silos that dominate the traditional advisory market. These competitive awards represent knowledge and expertise across the broadest range of evaluation criteria. Additionally, our Innovation Advisory platform is being spearheaded through New York City’s Urban Tech Hub in collaboration with their technology ecosystem. This integrated, interdisciplinary perspective is what our clients deserve. We invite you to join us for a spirited conversation about the way things are, the way they were, and they way they might become.

OUR TEAM

SUHRITA SEN

FOUNDER AND PRINCIPAL

SPECIALTIES

Strategic planning for infrastructure and real estate development; Project finance and public private partnerships; Procurement advisory; Governance, risk and controls assessments; Construction project and program management; CapEx/OpEx monitoring and audits; Asset management; Business process improvement and innovation advisory .

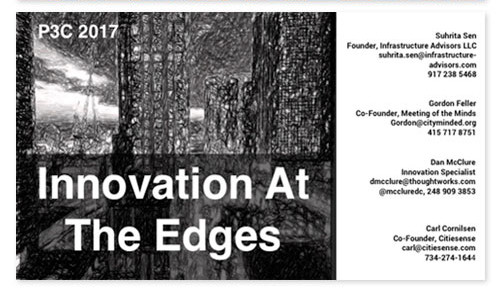

Suhrita’s extensive career in management consulting is distinguished by her success in serving the infrastructure, real estate, and construction industries. Suhrita’s experience includes: (i) Strategic advice for project development and financing of large scale real estate and infrastructure investments;. (ii) Infrastructure and real estate portfolio planning, financing; (iii) Construction Project and Program Management; (iv) Governance, risk and compliance assessments; (v) Asset management; as well as (vi) Feasibility studies, procurement advice, risk assessment, and project finance for alternative delivery across multiple sectors. Previously, her career has spanned leadership roles in two Big Four consulting organizations as well as in global engineering and consulting firms. With the privilege of a career that has spanned both financial and technical advisory roles; she has been at the forefront of the evolving P3 landscape nationally and internationally and has participated from both public and private sector perspectives. She is an Expert P3 Advisor with the US Department of Treasury’s Government Debt and Infrastructure Finance program and an Expert Risk Advisor to the Funding Committee of the Board for the North American Development Bank.

As a published author and presenter with a strong industry presence, she has received recognition as a subject matter expert globally. As an adjunct professor at Columbia University & CUNY, she has taught graduate courses in infrastructure and real estate. Suhrita is also an alumnus of Columbia University, and a PMP. She was selected as ‘WBC’s outstanding women 2016’ in Alternate Delivery, by the Women Builders Council, New York, and awarded ‘Leading Women in Global Advisory’ by IWLF Mumbai, India.

SARAVLEEN SINGH

ADVISOR – STRATEGY & MARKETS

SPECIALTIES

Public Private Partnerships, Tendering and Procurement Advisory, Contracts Management Advisory, Genera Financial Advisory include Financial Modeling, Debt raising/refinancing/restructuring Advisory, Acquisition and Divestment Advisory

- Public Private Partnerships- Advising government at federal, state, and municipal levels with the procurement of Infrastructure Projects on P3 format. Key areas of work included preparation of project feasibility report, financial models, regulatory tariff petitions, Project structuring, Bid Process Management, RFQ, RFP, and Concession Agreement.

- Tendering and Procurement Advisory- Advising Prime Contractors on submitting responses to RFQ and RFPs (including Unsolicited Proposals) and assisting with procurement of suppliers and subcontractors for a project.

- Contracts Management Advisory – Advising Government entities on development of Contract Management Framework for Construction Contracts awarded to Prime Contractors and Advising Prime contractors on subcontracts development.

- General Financial Advisory including Financial Modeling- Advising Public/Private entities on project cost estimation and reviews, cost of service valuation, evaluating various construction alternatives and estimating upfront user tariff.

- Debt raising/refinancing/restructuring Advisory- Advising Construction Companies/Developers on raising project finance for new projects, refinance for operational projects and debt restructuring for projects under financial stress.

- Acquisition and Divestment Advisory – Advising Pension Funds, Infrastructure Funds, and other Investors on acquiring Infrastructure Projects and Advising Government entities on recycling/stake divestment in owned Projects.

CHARLES SHORTER

SENIOR ADVISOR

SPECIALTIES

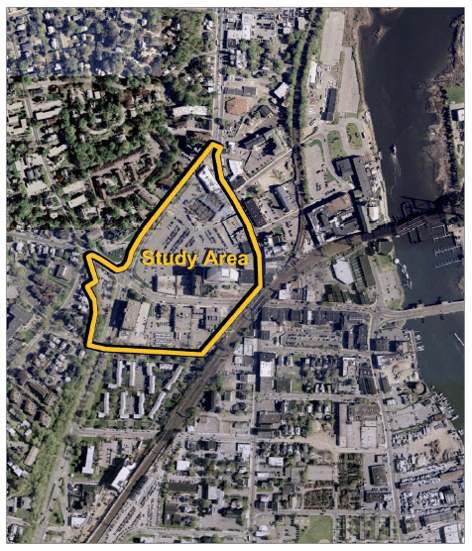

Public private development, Public private partnerships; Strategic planning; Market and financial feasibility analysis; Procurement advisory; Urban revitalization; Mixed use development; Economic impacts. Expertise spans all real estate types, with special emphasis on complex mixed-use urban development, recreational / cultural facilities, higher education and community development.

Charlie Shorter is a senior transaction advisor for Public Private Partnerships, and a specialist in real estate markets and finance. He has over 30 years of real estate and infrastructure industry experience involving market and financial feasibility analyses, economic impact studies, structuring public/private development partnerships, creating strategic approaches to large-scale mixed use projects and advising in negotiations with developers. He has extensive expertise in urban revitalization, transportation and transit oriented development, with emphasis on developer solicitation/selection, and implementation strategies for public-private ventures. He is an expert in successfully leading a public procurement process through RFQs and RFPs.

Charlie was the Leader of Ernst & Young LLP’s Public Private Transaction Advisory practice and also a Principal at Arthur Anderson LLP. He is currently a board member of the Association of Governing Boards of Universities and Colleges (AGB) as well as a Trustee for the City University of New York, where he serves on the Real Estate and Facilities Committee. Charlie is also a board member of the New 42nd Street Corporation which is responsible for developing the theaters and retail along 42nd Street in the Times Square area of New York City. He is member of the Urban Land Institute (ULI) where he serves on the Public Development Infrastructure Council. A frequent lecture/speaker on real estate trends, Charlie was for 20 years an Adjunct Faculty in the Master of Science in Real Estate at the Columbia University. He holds degrees from Princeton and Columbia Universities.

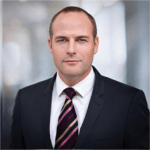

MICHAEL KERRIGAN

SENIOR ADVISOR

SPECIALTIES

Public Private Partnerships, Procurement Advisory, Technical and Commercial Advice, Due Diligence, Infrastructure Policy

Michael is an accomplished infrastructure executive with over 25 years’ experience across a wide breadth of infrastructure developments including vertical infrastructure, highway and transit for all stages of the project delivery lifecycle from inception to implementation. Michael has project managed and led infrastructure advisory teams in the delivery of large scale infrastructure and construction programs for projects in the U.S., Canada, Mexico and the U.K. As a project and program manager, he has led the input to all aspects of project development with both public and private sector clients.

Michael has extensive infrastructure sector experience developing and evaluating project concepts and delivery strategies; identifying and minimizing risks; project and program management; owner representative and construction monitoring; management and analysis of design, construction, operation and maintenance; project procurement for alternative project delivery; technical and commercial contract specifications with a particular focus on performance-based requirements; proposal evaluation and contract negotiations; development of risk adjusted design and construction cost estimates; development of risk adjusted operations, maintenance, and lifecycle cost estimates; project team leadership and management; client engagement, management and liaison; and project financial management. Michael has a Bachelor of Civil, Structural and Environmental Engineering and a Masters in Transportation Studies.

ZEBA IQBAL

SENIOR ADVISOR

SPECIALTIES

Real Estate Market and Economic Analysis ; Highest and Best Use Strategies; Re-Purposing and Re-Positioning Strategies; Development Management; Public Private Partnerships – RFQ, RFP, Evaluation and Award Processes.

Zeba Iqbal is an experienced real estate professional with 15 years experience in real estate planning and development processes for residential and mixed-use projects. Zeba’s experience includes: i) Project management of pre-development for large- scale real estate development; (ii) Strategic advisor on large public private real estate development projects; and (iii) Developer selection, master planning and feasibility studies for mixed-use, waterfront developments. Zeba has undertaken path finder mixed use ground lease public private partnerships on behalf of the public sector. She has been active in the social infrastructure sector overseeing University developed and managed faculty, staff and grad student housing and extended stay units. Zeba has a MBA from George Washington University.

SHUBHOMOY RAY

SENIOR ADVISOR – GLOBAL MARKETS

SPECIALTIES

Development Finance, Project Finance, Transaction Advisory, Public Private Partnerships.

Shubhomoy Ray has over twenty-three years of experience in consulting, investment banking and project finance in energy and infrastructure sectors across Asia and Africa, having advised and supported transactions cumulating to several billions of US Dollars in value. His experience includes various advisory assignments for The World Bank, IFC Washington, ADB, UN-ESCAP and USAID, and project financing transactions in India, Nepal, Bhutan, Afghanistan, Bangladesh, Myanmar, LaoPDR, Maldives, Mozambique, Uganda and Senegal. His expertise includes strategy, policy as well as due diligence, valuation and M&A work with renewable small and sustainable energy aggregation, solar PV, and hydro powered projects. He is also a Founder Director of InfraBlocks, Singapore– a blockchain and IOT based impact and SDG compliance measurement initiative.

Shubhomoy has deep understanding of project finance and export credit financing business, having worked on a number of financing transactions and brings valuable relationship with global project finance banks, export credit agencies, bilateral and multilateral institutions, infrastructure sector strategic counterparty investors and infrastructure funds. More recently, he has worked on several impact and sustainability focused project initiatives, helping them with formulating their business plans, transaction structuring and gaining access to capital. Shubhomoy has published several notable publications on the topic of Infrastructure Financing for sustainable development, including for the UNESCAP and ADB. He is a Sustainability Consultant to UNESCAP, Bangkok.

OUR STORIES

Our Insights

CONFERENCES

PRESENTATIONS

BLOGS

PRESS

Infrastructure Investment and Jobs Act

The Infrastructure Investment and Jobs Act (IIJA) is historic in its strong acknowledgment of the acute need for investment in the infrastructure sector. We are well positioned to support the Federal, State and Local governments identify, qualify and execute their infrastructure investment plans across sectors. Our insights support preparedness within the industry to deliver on this promise.

Contact Info

Infrastructure Advisors LLC, New York, NY

Email: contact@infrastructure-advisors.com

Phone: 917 238 5468